Fehri Khadri, in CACEIS’ Execution services team looks at 3 areas of concern in 2025 for trading desks looking to ensure a streamlined execution process for investment management clients.

- Liquidity sources are more fragmented than ever

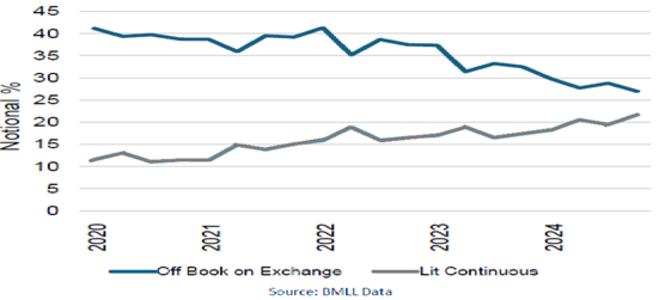

Even if Multilateral Trading Facilities (MTFs) and Primary Exchanges are key to sourcing liquidity, intra-day equities trading on orderbook has been declining since MiFID II implementation.

Apart from Multilateral periodic auctions on-book electronic trading is losing market share to off-book on-exchange bi-lateral trades.

Buy-side firms confirm that the trend will remain strong and will not reverse as trading large orders in bilateral mechanisms directly with a broad range of liquidity providers allow them to minimise leakage and market impact.

Off book and Lit trends of the four past years

New venue launches are mainly Duration Venues (CBOE’s VWAPX, Aquis’s VWAP Match) offering a trajectory-crossing execution mechanism based on volume weighted average price (VWAP) to attract liquidity.

- T+1: Facing up to the challenges of a shorter settlement cycle in Europe

Next, we turn our focus to the acceleration of the settlement cycle which in Europe is set to shorten from the current T+2 to T+1 on 11th October 2027 , joining the T+1 pioneers, India and China and more recent converts, the US, Canada, Mexico and Argentina.

The impetus to change in Europe is not simply to align with the key North American trading partners’ markets but also because regulators understand that shortening the duration between trade execution and settlement mitigates credit, operational and counterparty risk while reducing margin requirements, increasing liquidity and permitting more efficient use of capital.

However, eliminating the 1-day buffer between trade execution and settlement that was used to fix settlement mismatches, ensure timely funding, and prevent settlement failure, increases the need for upstream preparation work to avoid operational risk.

In terms of trade processing, T+1 affects the entire lifecycle of a trade from reference data set-ups to real-time trade matching, straight-through processing through to settlement. The US model uses a Confirmation-Affirmation process to ensure pre-matching of settlement instruction and if this becomes mandatory in Europe too, CACEIS is operationally ready to handle the process.

- Trading hours: Are extended or shortened trading hours on the cards for Europe?

Trading hours on the New York Stock Exchange (NYSE) may extend to a 22-hour day on its digital exchange in order to benefit from global demand for U.S. stocks. On the other side of the Atlantic, European exchanges, due to liquidity concerns during part of the day, are talking about shortening trading hours with the goal of improving liquidity concentration.

European exchanges’ current trading hours are some of the longest in the world with a day-trading window lasting on average around 8.5 hours. The calls to reduce Europe’s window are due to trading flows increasingly concentrating during the first and final few minutes of the trading session.

“Traders believe that shorten trading hours will create greater matching opportunities outside opening and closing auctions.” explains Fehri Khadri.

There has been no real demand for round-the-clock trading from institutional investors as they are able to perform their operations within the standard trading timeframe.

The main issue for Institutional investors and asset servicing groups like CACEIS, if there is a requirement to align with the US’ 23-hour trading, will be staffing. Hiring people to work nightshifts not just on the trading desks but also the qualified persons to run the entire risk management operations could be challenging.